how to calculate taxes taken out of paycheck in illinois

Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. This free easy to use payroll calculator will calculate your take home pay.

Illinois Income Tax Calculator Smartasset

How Much Taxes Is Taken Out Of A Paycheck In Illinois.

. To use our Illinois Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The wage base is.

Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding. Personal income tax in Illinois is a flat 495 for 2022. Rates are based on several factors including your industry and the amount of previous benefits paid.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck. For example if an employee earns 1500 per week the individuals.

After a few seconds you will be provided with a full breakdown of the. Unemployment Insurance UI supplies funding for the Illinois Department of Employment Security IDES which pays benefits to the unemployed. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124.

Some states follow the federal tax year some. Supports hourly salary income and multiple pay frequencies. What percentage is taken out of paycheck taxes.

The 2023 Tax Calculator uses the 2023 Federal Tax Tables and 2023 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. Personal income tax in Illinois is a flat 495 for 20221. As of January 1 2022 the Illinois unemployment tax rate ranges from 0725 to 7625.

You can even use historical tax years to figure out your total salary. 495Everyones income in Illinois is taxes at the same rate due to the states flat income tax system of 495. The Illinois Paycheck Calculator uses Illinois tax tables and Federal Income Tax Rates for 2022.

Just enter the wages tax withholdings and other information required. Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding amount its not that easy. The state tax year is also 12 months but it differs from state to state.

Illinois Hourly Paycheck Calculator. It can also be used to help fill steps 3 and 4 of a W-4 form. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

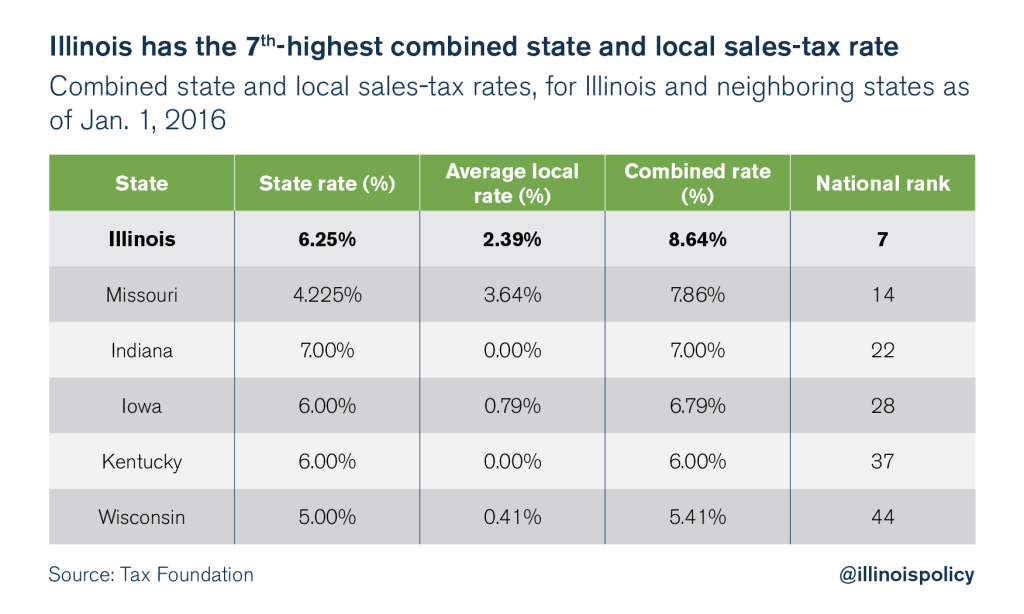

Illinois Is A High Tax State Illinois Policy

Gas Tax Rates By State 2021 State Gas Taxes Tax Foundation

Taxes 5 1 Taxes And Your Paycheck Payroll Taxes Based On Earnings Paid To Government By You And Employer Income Taxes You Pay On Income You Receive Ppt Download

How To Calculate Child Support In Illinois With Pictures

Paycheck Calculator W 4 Help Paycheck Details Form W 2

Illinois Retirement Tax Friendliness Smartasset

State W 4 Form Detailed Withholding Forms By State Chart

How Many Tax Allowances Should I Claim Community Tax

Illinois Estate Tax Everything You Need To Know Smartasset

Illinois Payroll Tax Guide 2022 Cavu Hcm

Illinois Payroll Tools Tax Rates And Resources Paycheckcity

How Many Tax Allowances Should I Claim Community Tax

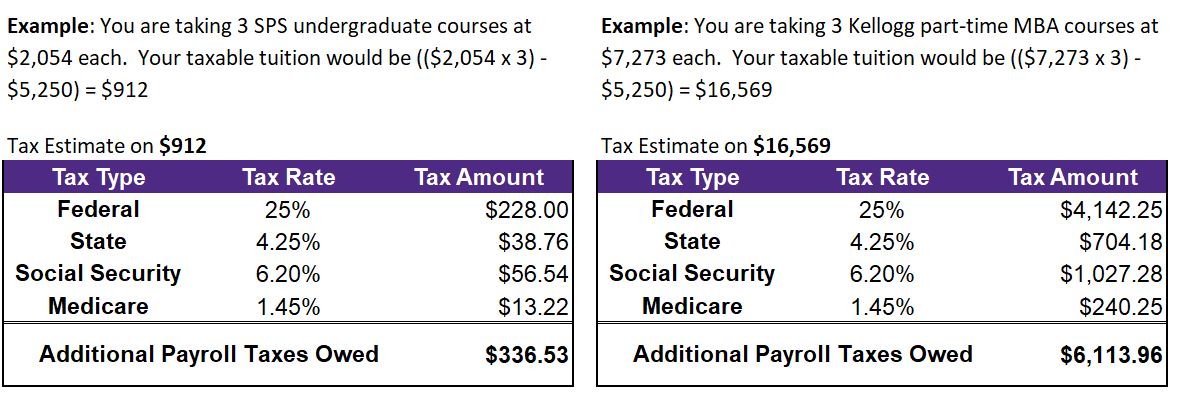

Tuition Taxation Human Resources Northwestern University

Illinois Paycheck Calculator Adp

New Tax Law Take Home Pay Calculator For 75 000 Salary

Free Paycheck Calculator Hourly Salary Usa Dremployee

Chapter 5 Taxes Ppt Video Online Download